Fx gainloss definition foreign currency gains and losses also known as exchange rate gains and losses is an accounting concept used to define the impact on international businesses financial statements of the fluctuation of the exchange rate of the non functional currencies in which the company holds monetary assets and liabilities. Realized income or losses refer to profits or losses from completed transactions.

Best Forex Brokers In 2019 Fee Comparison Included

Best Forex Brokers In 2019 Fee Comparison Included

A realised loss would be registered as an expense and would specify that it is a loss related to currency exchange.

:brightness(10):contrast(5):no_upscale()/GettyImages-483658563-5756fd9e5f9b5892e8e0da65.jpg)

Fx loss meaning. As all other non base currency details eg net trade sales and purchases commissions interest etc are booked as of the end of day for currency translation purposes they have by definition no translation gain or loss. Recording a loss when completing a transaction step. Foreign exchange gain or loss definition foreign exchange gains and losses or fx gains and losses is an accounting concept referring to the impact of foreign exchange risk in the financial statements of businesses monetary assets and liabilities denominated in currencies other than their functional currency.

If the foreign currency exchange rate changes unfavorably record a loss. Realized and unrealized gains and losses explanation in accounting ! there is a difference between realized and unrealized gains an! d losses.. It would be a mistake not to mention the dynamic trailing stop loss in forex trading.

Forex fx futures a forex or currency futures contract is an agreement between two parties to deliver a set amount of currency at a set date called the expiry in the future. There are many types of trailing stops and the easiest one to implement is the dynamic trailing stop. Viele ubersetzte beispielsatze mit fx losses deutsch englisch worterbuch und suchmaschine fur millionen von deutsch ubersetzungen.

An unrealised gain or loss would be noted as an exchange loss in the asset section of your records. It would also be recorded as an exchange loss on the liability section. There are many types of trailing stops and the easiest one to implement is the dynamic trailing stop.

A foreign exchange hedge also called a forex hedge is a method used by companies to eliminate or hedge their foreign exchange risk resulting from! transactions in foreign currencies see foreign exchange derivative. In the example if 200 euros now equals 300 then debit accounts payable by 250 foreign exchange loss by 50 then credit cash by 300.

/Courses-Currency-Pairs-Stock-Exchange-Forex-643727-569a829c8446483b945ca8fd1c05e320.jpg) Forex Leverage A Double Edged Sword

Forex Leverage A Double Edged Sword

Risk Management Vs Money Management 1 Guide For Forex

Risk Management Vs Money Management 1 Guide For Forex

Foreign Exchange Gain Loss Overview Recording Example

Foreign Exchange Gain Loss Overview Recording Example

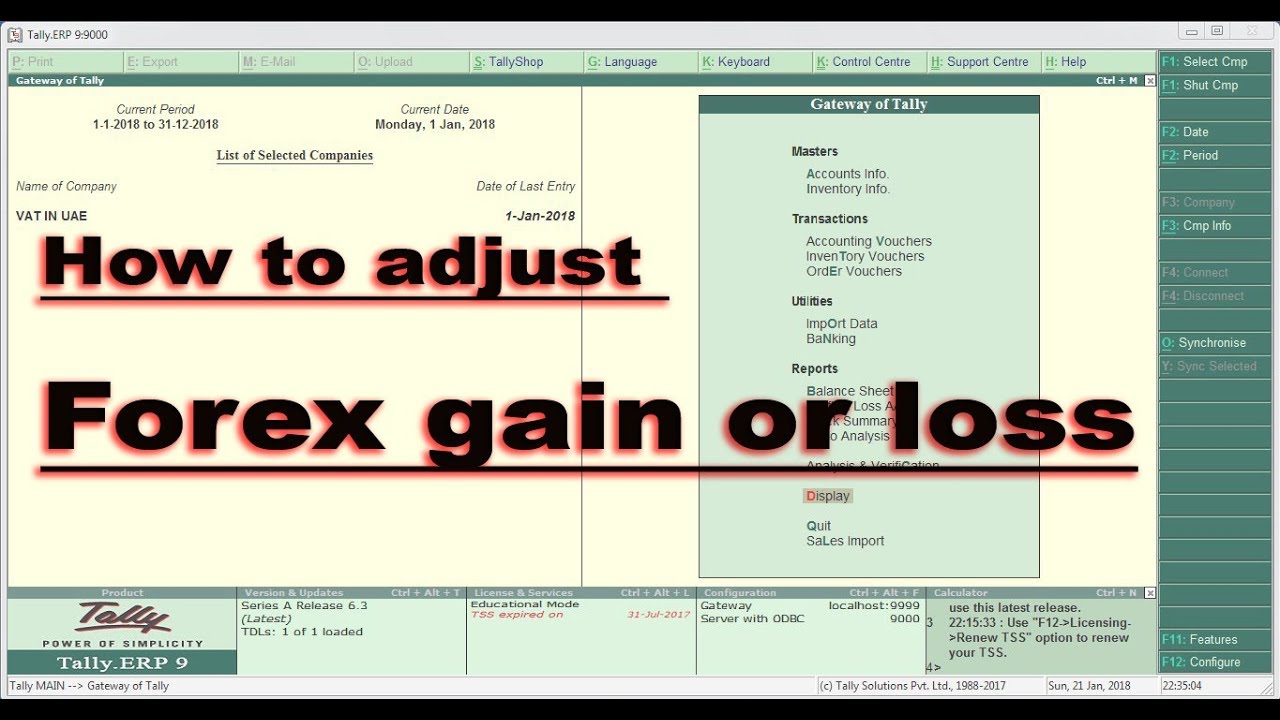

How To Make Journal Entry For Unadjusted Forex Gain Loss

How To Make Journal Entry For Unadjusted Forex Gain Loss

Bid Ask Meaning Forex Find The Right Forex Trading Strategy For You

Bid Ask Meaning Forex Find The Right Forex Trading Strategy For You

Profit And Loss

Profit And Loss

What Does A Forex Spread Tell Traders

What Does A Forex Spread Tell Traders

Forex Stop Loss Meaning

Forex Stop Loss Meaning

What Is A Pip In For! ex Babypips Com

What Is A Pip In For! ex Babypips Com

What Is Equity In Forex Trading

What Is Equity In Forex Trading

Loss And Gain Forex E

Loss And Gain Forex E

Forex Fx Forex Definition Forex Meaning Forex Currency Forex

Forex Fx Forex Definition Forex Meaning Forex Currency Forex

Stop Loss And Take Profit In Forex Profitf Website For Forex

Unrealized Gains Losses Examples Accounting For Unrealized

Unrealized Gains Losses Examples Accounting For Unrealized

What Is Forex Trading And How Does It Work

What Is Forex Trading And How Does It Work